Oil prices have been rangebound for the last four weeks with demand

concerns being

canceled out by expectations of an OPEC+ production cut extension.

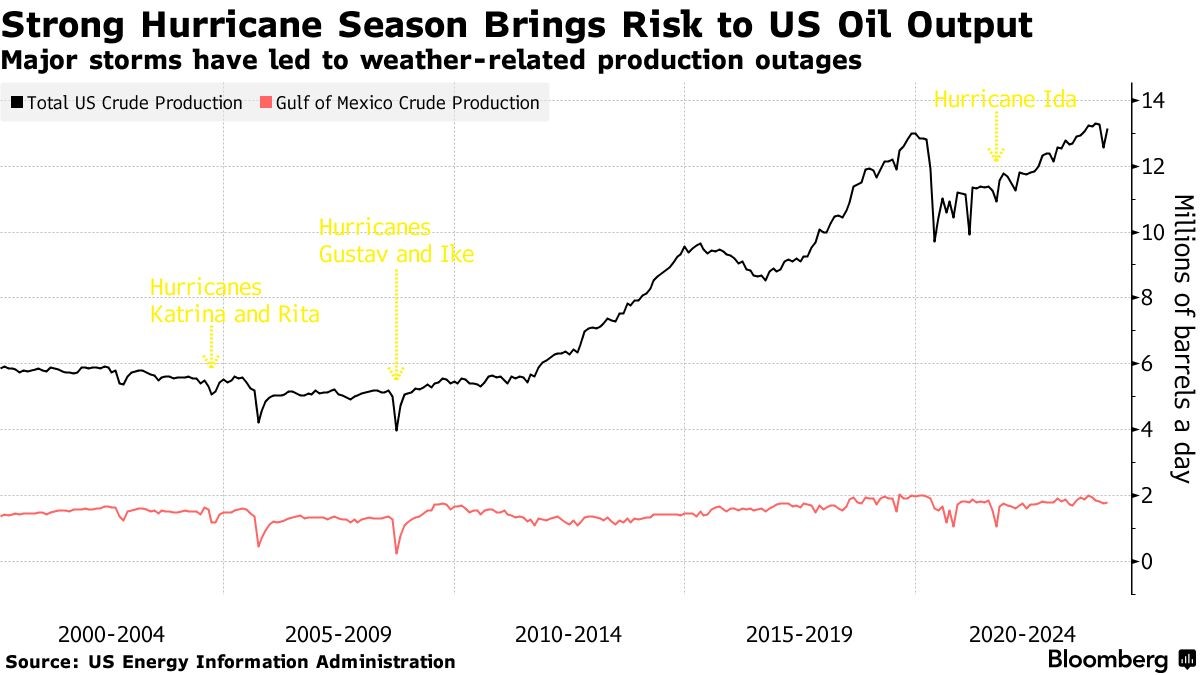

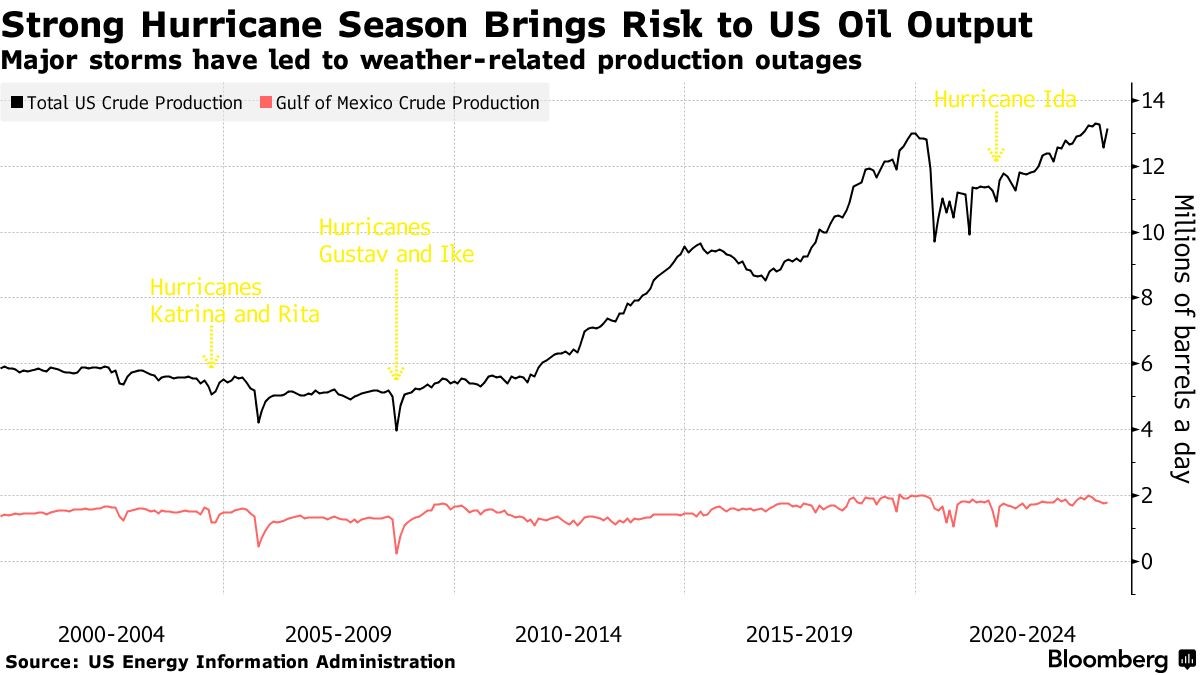

- The latest forecast from the US

National Oceanic and Atmospheric Administration (NOAA) confirmed

that this year’s Atlantic hurricane season is expected to be above

normal, with the potential for 17 to 25 named storms from June to

November.

- With 8 to 13 of those storms likely to develop into hurricanes,

almost double the past year’s average, 2024 might see heightened

risks for production from the US Gulf of Mexico and refineries

across the Gulf Coast.

- Offshore oil fields in the US Gulf of Mexico account for 15% of

total crude production in the country (1.8 million b/d) and the

overwhelming majority of medium sour supply, while for natural gas

the same metric stands at 5%.

- The concentration of US refining along the Texas and Louisiana

Gulf Coast is even stronger, corresponding to almost half of US

downstream capacity, while the same strip accounts for 90% of all US

seaborne crude exports.

Market Movers

- Rating agency Moody’s downgraded Colombia’s state energy company

Ecopetrol (NYSE:EC) into junk territory, citing

increasing debt levels amidst higher dividends and a hefty

investment plan.

- Spanish oil major Repsol (BME:REP) is reportedly

seeking to sell a stake in its 800 MW renewable asset portfolio in

the United States, with Saudi Aramco seemingly keen to farm in.

- Chinese offshore specialist CNOOC (HKG:0883)

signed oil exploration and production deals with Mozambique’s energy

ministry to develop five offshore blocks covering a total area of

29,000 km2.

Tuesday, May 28, 2024

Oil prices have been trading rangebound for the fourth consecutive

week, staying within the $81-83 per barrel range for Brent, as

priced-in expectations of OPEC+ maintaining production curbs have

failed to lift sentiment any higher. While improving consumption

figures from the US and an increasingly bullish picture for

hurricanes in the US Gulf Coast provide some medium-term hope for

oil bulls, the macro outlook is still weak and the prospect of Fed

interest rate cuts in June is getting slimmer.

EU Approves Stringent Methane Controls.

The European Union approved a law this week to impose methane

emission limits on Europe’s oil and gas imports from 2030, setting

maximum methane intensity

values on

all fossil fuels that would trigger financial penalties, if

flouted.

Saudi Aramco Could Launch SPO in June.

According to media

reports,

Saudi Arabia’s national oil company Saudi Aramco

(TADAWUL:2222) could launch a multi-billion-dollar share

sale as soon as June, with the presumed offering aiming to generate

some $10 billion for the state coffers.

Russia to Build Nuclear Plant in Uzbekistan.

The Central Asian Republic of Uzbekistan is set to

become

the next addition to the list of countries developing nuclear

energy, the first in the region, agreeing to build six smaller 55 MW

reactors instead of the initial plan for 2.4 GW capacity.

Iran Keeps on Dreaming Big. The recent

death of President Raisi notwithstanding, the Iranian government has

approved

a plan to increase oil production to 4 million b/d from the current

target of 3.6 million b/d, however without providing a time frame

for the capacity uptick.

Mexico’s Production Is Collapsing Amidst Debt.

As Mexico’s crude output dropped to a 40-year low of 1.47

million b/d last month, the country’s state oil firm Pemex has been

struggling

to repay service providers including drillers, with the NOC

reporting $21.9 billion in pending payments in its Q1 results.

Hedge Funds Turn Ultra Bullish on Gold.

The net length held by hedge funds and other large speculators in

Comex gold futures and options rose by a further 21,030 contracts in

the week ending May 21, bringing the totals to the highest level

since mid-April 2020 as gold

boosts

its safe-haven credentials.

BlackRock Wants Anglo to Merge. US asset

management giant BlackRock (NYSE:BLK) has

encouraged

London-based mining firm AngloAmerican (LON:AAL) to

continue engaging in negotiations with BHP over its proposed 50

billion merger, with a final bid expected by May 29.

Shell, BP Quit South African Refining.

Europe’s energy majors Shell (LON:SHEL) and

BP (NYSE:BP) have agreed to sell their 180,000 b/d Sapref

refinery in Durban, out of operation since a 2022 flooding, to the

South African government for a symbolic one rand.

Australia’s CCS Ambition Takes a Huge Hit.

Australia’s Queensland state government

rejected

a pilot CCS project developed by Glencore (LON:GLEN)

in the Surat Basin, arguing that permanent storage of carbon dioxide

from a coal-fired power station could impact groundwater resources.

New Petrobras CEO Seeks to Assuage Markets.

Magda Chambriard, the newly anointed head of Brazil’s national oil

company Petrobras (NYSE:PBR), has

vowed to

keep investor returns in mind after her predecessor Jean-Paul Prates

was ousted amidst government pressure to spend on job creation.

US to Continue Buying Venezuelan Asphalt.

Global Oil Terminals, a US oil trading company owned by Harry

Sargeant III, has

received

a US Treasury waiver to continue importing Venezuelan asphalt to the

United States and to interact with PDVSA over the next two years.

Majors’ Bids Lift Outlook on Trinidad’s Upstream.

Trinidad and Tobago said it

received

bids from BP (NYSE:BP), Shell (LON:SHEL), and

EOG Resources (NYSE:EOG) as part of its 2023

shallow water licensing round, all bidding for the Modified UC

block, with the winner to be announced soon.

Congo Boasts First Offshore Discovery in Decades.

The Congolese subsidiary of Africa-focused upstream firm Perenco

discovered

oil with its Moke-East exploration well off the coast of the

Democratic Republic of Congo, the first offshore oil find there in

almost three decades.

Tom Kool

Editor, Oilprice.com

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212